Έρευνα έδειξε ότι οι Ελληνες ζημιώθηκαν μπαίνοντας στην ΕΕ, με στοιχεία 1981-2008

Posted: 7 Μαρτίου 2016 in Αποκαλύψεις-άρθρα, οικονομίαΕτικέτες:Aποκαλύψεις-άρθρα

Σε άρθρο του βρετανικού Economist, στις 14 Απριλίου 2014, αναφέρεται ότι ενώ μόλις την περασμένη εβδομάδα το Ινστιτούτο Οικονομικών Υποθέσεων της Βρετανίας βρέθηκε να απονέμει βραβείο € 100.000 ($ 140.000) στον νικητή διαγωνισμού για το σχεδιασμό το καλύτερου σχεδίου βρετανικής επιτυχίας μετά το «Brexit»: την υποθετική αποχώρηση της Βρετανίας από την ένωση, μια άλλη έρευνα ταράζει τα νερά στην ΕΕ.

Σε άρθρο του βρετανικού Economist, στις 14 Απριλίου 2014, αναφέρεται ότι ενώ μόλις την περασμένη εβδομάδα το Ινστιτούτο Οικονομικών Υποθέσεων της Βρετανίας βρέθηκε να απονέμει βραβείο € 100.000 ($ 140.000) στον νικητή διαγωνισμού για το σχεδιασμό το καλύτερου σχεδίου βρετανικής επιτυχίας μετά το «Brexit»: την υποθετική αποχώρηση της Βρετανίας από την ένωση, μια άλλη έρευνα ταράζει τα νερά στην ΕΕ.Στην τελευταία έκθεση των Nauro Campos από το Brunel University, Fabrizio Coricelli του ParisSchool of Economics και του Luigi Moretti του University of Padua, διαβάζουμε ότι οι τρείς ερευνητές επινόησαν αυτό που αποκαλούν ως «συνθετική αντίστροφη κατάσταση», δηλαδή μιαπροβολή για το πώς οι οικονομίες μελών της ΕΕ θα ήταν τώρα, αν δεν είχαν ενταχθεί στην ΕΕ, αντικαθιστώντας τα δεδομένα από τρίτες χώρες με παρόμοιες οικονομίες.

Για να εξασφαλίσουν σωστότερα αποτελέσματα, δεν χρησιμοποίησαν δεδομένα από μία μόνοπαρόμοια χώρα, αλλά αντ ‘αυτού χρησιμοποιήθηκε ένας σταθμισμένος συνδυασμός δεδομένωναπό διάφορες χώρες. Έτσι η εκτός ΕΕ – Βρετανία, για παράδειγμα, είναι 91% Νέα Ζηλανδία και 9% Αργεντινή. Τα μακροοικονομικά στατιστικά στοιχεία των χωρών αυτών, σταθμισμένα σε αυτές τις αναλογίες, διερευνήθηκαν διεξοδικά μαζί με εκείνα της Βρετανίας πριν από την ένταξή της στην Ευρωπαϊκή Ένωση.

Η έκθεση στη συνέχεια συγκρίνει την απόδοση των συνθετικών υποκατάστατων με ταπραγματικά τους αντίστοιχα, μετά την ένταξη των τελευταίων στην ΕΕ.

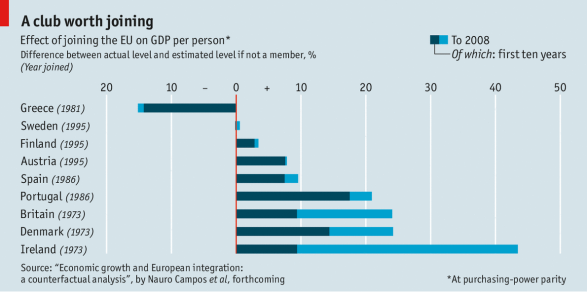

Όπως αναφέρει και ο Economist, από τα μεγέθη ξεχωρίζει περισσότερο η επίδοση της Ελλάδας. Κάποιος θα συμπέρανε αμέσως ότι αυτό πρέπει να οφείλεται στην κρίση του ευρώ. Δεν ισχύει όμως καθώς οι εκτιμήσεις κινούνται μόνο μέχρι το 2008

Η υπόλοιπη περιφέρεια της ευρωζώνης έχει υποστεί μια σχετικά μικρή πτώση του κατά κεφαλήν ΑΕΠ ανά άτομο από την ένταξη των χωρών έως το 2008.

Η Ελλάδα όμως γνώρισε μια εκπληκτική κατάρρευση του κατά κεφαλήν ΑΕΠ , περίπου 17%εως το 2008, επηρεάζοντας μια γενιά για την οποία τελικά η ένταξη στην Ευρωπαϊκή Ένωση έφερε λιγότερα από ότι αν δεν είχε συμβεί.

Μετάφραση – Απόδοση αποσπάσματος: LEFTeria-news

Διαβάστε ολόκληρο το άρθρο του Economist, πατώντας στο link

The European economy

The Greek miscalculation

REPUTATIONALLY speaking, the European Union has had better moments (though Russia is doing its best to restore the appeal of linkages to the west). Thanks to the crisis in the euro zone, many of the EU’s economies remain mired in near-recession conditions almost seven years after the first rumblings of global financial trouble. Anti-EU parties are on the rise. Just last week Britain’s Institute of Economic Affairs awarded a €100,000 ($140,000) prize to the winner of a contest to design the best plan for British success after «Brexit»: Britain’s hypothetical departure from the union.

The sentiments aren’t that difficult to comprehend; in addition to recent economic troubles there is the general dissatisfaction with the perceived impositions of eurocrats in Brussels: distant, unresponsive, foreign busybodies. And sadly for the EU, people seem to take its long-run economic benefits for granted, or assume there simply haven’t been any.

That is because the counterfactual—a world in which the union never formed—is impossible to observe. And that fact has bedeviled economists’ attempts to figure out just how important a half century’s worth of economic integration, in breadth and depth, has been to the European economy. A new piece of research, presented at last week’s Royal Economic Society conference in Manchester, uses a novel approach to try to overcome that hardship, however. The paper suggests not only that economists’ intuition—that integration has been beneficial—is right, but that the gains are in most cases quite substantial.

This week’s Free exchange column explains their approach:

In the new paper Nauro Campos of Brunel University, Fabrizio Coricelli of the Paris School of Economics and Luigi Moretti of the University of Padua reckon that these approaches, though useful, can be improved upon. They concoct what they call a “synthetic counterfactual”, meaning a projection of how EU members’ economies would have performed had they not joined the EU, by substituting data from non-member countries with similar economies. To ensure a good match, they do not use data from just one similar country, but instead use a weighted blend of the data from several countries. Thus their non-EU Britain, for instance, is 91% New Zealand and 9% Argentina (an amalgam Eurosceptics will no doubt pounce on). The macroeconomic statistics of those countries, weighted in those proportions, closely track those of Britain before it joined the EU.

The paper then compares the performance of the synthetic substitutes to their real counterparts after accession. This clever device is not without problems, but the authors reckon it may understate the benefits of EU membership. Synthetic Lithuania, for instance, is 42% Ukraine. But proximity to the EU may have brought some benefits to Ukraine, which in turn boost the projected performance of synthetic Lithuania. That makes the gain to the real Lithuania from joining look smaller than it really is.

You can see some of the estimated gains in the chart below. Gains to entrants in the 2004 enlargement are estimated to be similar to those in previous expansions, amounting to a rise in real output per person of about 13% relative to the counterfactual case. (Latvia’s 53% rise is the largest of any EU member.)

Other than the bottom-line magnitudes involved, the thing which stands out most is Greece’s awful, and stunningly anomalous, performance. One immediately imagines this must be due to the euro crisis. It isn’t; the estimates only run through 2008. The rest of the euro-area periphery has suffered relatively modest declines in real output per person since 2008 after enjoying a hefty prior boost from EU membership; Greece has experienced a stunning collapse in real output per person, of about 17% since 2008, on the heels of a generation in which membership appeared to weigh down the Greek economy below where it might otherwise have been.

Could this be a statistical artefact? Some of it might be. As nifty as the strategy employed by the authors is, the relatively small number of economies in the donor pool does look a weakness. If the counterfactual series is built from just three or four other economies, then an idiosyncratic turn in one of those economy’s fortunes could have a dramatic impact on the EU’s estimated benefits. Greece’s performance relative to the counterfactual probably was hurt a bit by the relatively high weight put on Japan, for instance, which enjoyed a red hot decade in the 1980s. But the ingredient mix just isn’t different enough to explain the wildly different outcome. Japan is also a significant contributor to the Irish counterfactual, and yet Ireland’s performance is among the best recorded. And the authors do run several robustness checks to try and rule out the possibility that one odd time series is distorting their results. It would be interesting to see the authors build counterfactuals from a set of global macro variables, to see whether the results differ. But the paper’s estimates look strong enough to take seriously.

The question then becomes why Greece fared so poorly and how that performance contributed to its recent economic disaster. The most straightforward interpretation of the Greek figures is that it simply failed to integrate effectively with the rest of the European economy. The rest of the periphery was tying itself into EU supply chains, experiencing capital deepening and ungrading technological capabilities, contributing to a rise in underlying growth potential. Greece wasn’t. The southward rush of capital that occurred in the 2000s may therefore have pushed Greece much, much farther beyond potential than was the case in Spain or Portugal. In other words, we see another example of the way in which the Greek government’s profligacy was more symptomatic of the economy’s troubles than a principal cause of them.

There may be a bright side here for Greece. If a failure to integrate helps explain recent woes, then perhaps that also means that Greece has more capacity to grow rapidly in future as it goes through the integration others enjoyed previously. Assuming, that is, that Greeks themselves remain committed to a club that has yielded them paltry benefits relative to what might have been expected.

Δεν υπάρχουν σχόλια:

Δημοσίευση σχολίου